| Name | Coverage Start | Coverage Status |

|---|---|---|

|

Member Demo

Subscriber - DOB 10/20/1965

|

Coverage Start

06/01/15

|

Coverage Status

Active

|

|

Spouse Demo

Domestic Partner - DOB 01/01/1964

|

Coverage Start

06/01/15

|

Coverage Status

Active

|

|

Child Demo

Dependent - DOB 05/01/2005

|

Coverage Start

06/01/15

|

Coverage Status

Active

|

| Name | Coverage Start | Coverage Status |

|---|---|---|

|

Member Demo

Subscriber - DOB 10/20/1965

|

Coverage Start

01/01/16

|

Coverage Status

Active

|

|

Spouse Demo

Domestic Partner - DOB 01/01/1964

|

Coverage Start

06/01/15

|

Coverage Status

Active

|

|

Child Demo

Dependent - DOB 05/01/2005

|

Coverage Start

01/01/16

|

Coverage Status

Active

|

| Name | Coverage Start | Coverage Status |

|---|---|---|

|

Member Demo

Subscriber - DOB 10/20/1965

|

Coverage Start

01/01/16

|

Coverage Status

Active

|

|

Spouse Demo

Dependent - DOB 01/01/1964

|

Coverage Start

01/01/16

|

Coverage Status

Active

|

|

Child Demo

Dependent - DOB 05/01/2005

|

Coverage Start

01/01/16

|

Coverage Status

Active

|

The amount you owe for health care services your health insurance or plan covers before your health insurance or plan begins to pay. For example, if your deductible is $1000, your plan won't pay anything until you've met your $1000 deductible for covered health care services subject to the deductible. The deductible may not apply to all services.

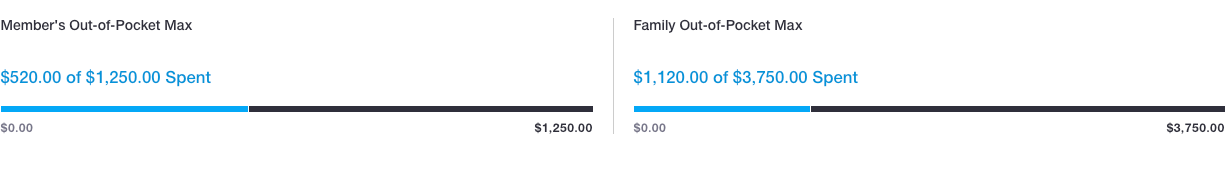

The most you pay during a policy period (usually a year) before your health insurance or plan begins to pay 100% of the allowed amount. This limit never includes your premium, balance-billed charges or health care your health insurance or plan doesn’t cover. Some health insurance or plans don’t count all of your co-payments, deductibles, coinsurance payments, out-of-network payments or other expenses toward this limit.

Your share of the costs of a covered health care service, calculated as a percent (for example, 20%) of the allowed amount for the service. You pay coinsurance plus any deductibles you owe. For example, if the health insurance or plan's allowed amount for an office visit is $100 and you've met your deductible, your coinsurance payment of 20% would be $20. The health insurance or plan pays the rest of the allowed amount.

As of 09/05/2018

![]() You May Owe

You May Owe

$30.00

![]()

![]() You May Owe

You May Owe

$30.00

![]()

![]() You May Owe

You May Owe

$1,101.00

![]()

![]() You May Owe

You May Owe

$0.00

Virtual Visits let you see and talk to a doctor whenever you want. 24 hours a day, 7 days a week.

Learn more about how OptumRx® may save you time and money through home delivery.

Please help us make our website even better by taking a short survey.

UnitedHealth Premium Tier 1 physicians have been recognized for meeting national standards for quality and cost of care.

A PCP is the main doctor that takes care of you. Visit a PCP for things like routine care, yearly checkups and other general health concerns. Each family member covered under your plan can have their own PCP, or you may all choose to see the same one.

Find a doctor$20 Copay after deductible is met

$50 Copay after deductible is met

This is a fixed amount you pay for a covered health service at the time of service. The amount may change based on the service.

This is your share of the cost for covered health services.

A physician specialist focuses on a specific area of medicine or a group of patients to diagnose, manage, prevent or treat certain types of symptoms and conditions. A non-physician specialist is a provider who has more training in a specific area of health care.

Find a specialist$50 Copay after deductible is met

$100 Copay after deductible is met

This is a fixed amount you pay for a covered health service at the time of service. The amount may change based on the service.

This is your share of the cost for covered health services.

Visit an Urgent Care facility when you may need care quickly, but it is not an emergency, and your regular doctor may not be available. Urgent care centers offer treatment for non-life-threatening injuries or illnesses and are staffed by qualified physicians.

This is a fixed amount you pay for a covered health service at the time of service. The amount may change based on the service.

This is your share of the cost for covered health services.

When searching for a provider look for the In-Network badge.

In-networkAvoid Out-of-Network providers if possible.

This is a fixed amount you pay for a covered health service at the time of service. The amount may change based on the service.

This is your share of the cost for covered health services.

Go to an Emergency Room when you need immediate treatment for a very serious or critical condition. The ER is for the treatment of life-threatening or very serious conditions that require immediate medical attention. Do not ignore an emergency. If you have a life-threatening situation, call 911 or your local emergency phone number right away.

Find an emergency room10% Coinsurance after deductible is met

30% Coinsurance after deductible is met

This is a fixed amount you pay for a covered health service at the time of service. The amount may change based on the service.

This is your share of the cost for covered health services.

A PCP is the main doctor that takes care of you. Visit a PCP for things like routine care, yearly checkups and other general health concerns. Each family member covered under your plan can have their own PCP, or you may all choose to see the same one.

Find a doctorThis is a fixed amount you pay for a covered health service at the time of service. The amount may change based on the service.

This is your share of the cost for covered health services.

When searching for a provider look for the Tier 1 badge.

UnitedHealth Premium® Tier 1

When searching for a provider look for the In-Network badge.

In-networkAvoid Out-of-Network providers if possible.

This is a fixed amount you pay for a covered health service at the time of service. The amount may change based on the service.

This is your share of the cost for covered health services.

Using in-network providers is a great way to get the best value from your UnitedHealthcare plan.

You may save on out-of-pocket costs when you visit in-network versus out-of-network doctors and facilities.

Your in-network deductible and out-of-pocket maximum may be lower so you can meet them sooner and save more.

Using preferred providers can save you money too. It's easy to find them. Just look for these badges.

Indicates that a doctor or facility is in-network.

You may pay less for services at these facilities, including outpatient, diagnostic, or ambulatory centers or independent labs.

These doctors provide quality and cost-efficient care, which can save you money throughout your treatment.

Choosing services from these laboratories can cost you less.

Indicates that a doctor or facility is in-network.

These doctors provide quality and cost-efficient care, which can save you money throughout your treatment.

You may pay less for services at these facilities, including outpatient, diagnostic, or ambulatory centers or independent labs.

Choosing services from these laboratories can cost you less.

A primary care doctor (PCP), or general practitioner, is the person you likely see for most medical issues, annual checkups, and preventive screenings. Your PCP may know you best overall, and can provide comprehensive care. You may start a consultation with a primary care doctor, who then refers you to a specialist for more advanced treatment or advice, if needed. A primary care doctor can also help you coordinate the care you get from specialists and other providers.

If you have a complex condition that your primary doctor isn’t equipped to treat, you may need to see a specialist. This doctor has more education and training in a particular specialty than a PCP. Most HMO insurance plans require a referral from your primary physician before you can see a specialist. You may also be charged more for a visit with a specialist than a PCP, depending on your coverage.

When you don't feel well or your child is sick, the last thing you want to do is sit in the doctor's waiting room. With virtual visits, you can see and speak to a doctor online anytime from your mobile device or computer. Virtual visits are ideal for minor health care needs or symptoms, like colds, seasonal allergies or fevers. The doctor can write a prescription, but virtual visits are not intended to address emergency or life-threatening medical conditions.Not available in all states or plans.

Not available in all states or plans.

An urgent care center can be a good option if you need care fast but your primary care physician is unavailable. They can treat many minor injuries and ailments, and the chances are you won't have to wait as long as at the ER. You may pay less, too.

You may be tempted to go to the emergency room (ER) for any medical need that requires immediate attention. But this may not always be the best choice. At the ER, true emergencies are treated first. If your problem is not life threatening, you might have to wait — sometimes for hours. And an ER visit can cost you more than the other options.

When you don't feel well or your child is sick, the last thing you want to do is sit in the doctor's waiting room. With virtual visits, you can see and speak to a doctor online anytime from your mobile device or computer. Virtual visits are ideal for minor health care needs or symptoms, like colds, seasonal allergies or fevers. The doctor can write a prescription, but virtual visits are not intended to address emergency or life-threatening medical conditions.Not available in all states or plans.